Guidance in Wealth Management - Individual Advice & Support

Every wealth situation is as unique as the person behind it. Our work for you therefore begins with a structured analysis of your personal and financial circumstances: What purpose should your assets serve? What assumptions still apply – and what needs to be re-evaluated?

Decisions require careful consideration; not every market movement demands a reaction. Wealth accumulation and preservation are based on continuity and a long-term, focused perspective.

Our advice aims to carefully weigh opportunities and risks, diversify assets effectively, and integrate decisions into a long-term overall strategy.

Retirement planning is not simply a matter of calculation. A well-thought-out asset structure can create financial stability and meaningfully complement traditional investment strategies.

We support you in the implementation process and are available as a reliable sparring partner when financial decisions are pending.

During periods of reorganization - support with experience & empathy

Family separation, inheritance, business succession, or career changes require a careful, structured review of your financial situation. In such transitions, the initial focus is not on quick fixes, but on gaining clarity and perspective: What assets are available? What liabilities exist? What priorities are changing?

A clear assessment of the overall situation forms the basis for sound decisions – and we will then guide you step by step toward a new structure and stability. In such situations, we combine professional precision with the necessary empathy, discretion, and clarity.

Invitation to a talk

An initial consultation allows us to calmly assess your situation, provide initial guidance, and clarify any key questions.

Our consultation is independent, structured, and transparent. The consultation can take place at our offices in Bensberg or, if you prefer, at your home. Simply contact us via our contact form or directly by email: info@martlutherinvest.com – or call us directly: +49 2204 / 300 63 97.

Financial Guidance

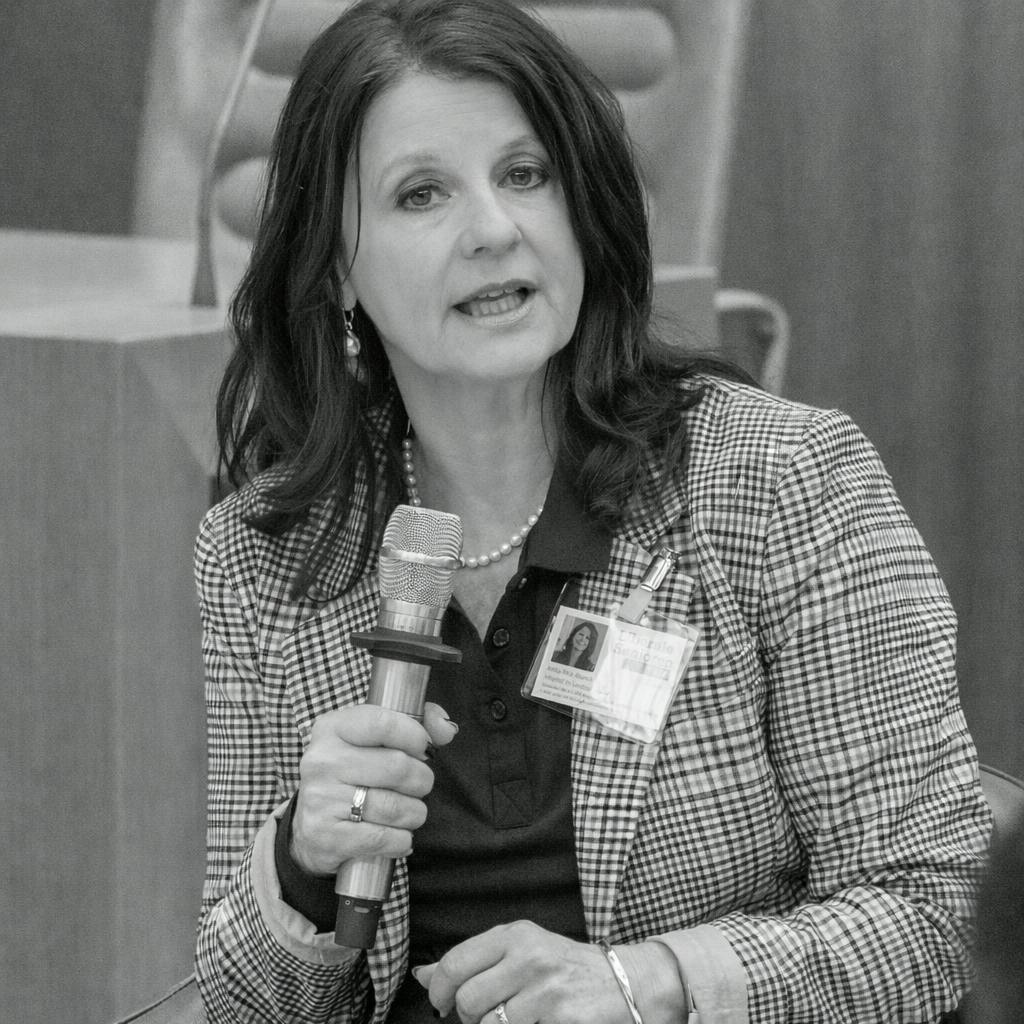

Anita Rick-Blunck provides insights into money, wealth, and financial self-determination.

Through lectures and discussions, she offers guidance on financial matters that require more than just mathematical models.

Her focus is on context, clarity, and perspectives that enable participants to reflect more consciously on their own relationship with money and prepare for sound decisions within their current context.

Her insights combine economic understanding with practical application and are aimed particularly at entrepreneurs and individuals undergoing periods of reorientation.

Our philosophy

The company name is inspired by Martin Luther as a Bible translator and represents our commitment to making complex issues understandable. We utilize capital market expertise and proven techniques to carefully balance opportunities and risks – and explain these connections in clear, comprehensible language. We see our role as providing responsible guidance – with respect for what wealth means to each individual.

Anita Rick-Blunck

Managing Director Martluther Investment GmbH | Economist & Economic Psychologyist LMU Munich | Certified Financial Investment Specialist IHK Cologne

- Public & Investor Relations

- Investment advice

- Long-term sales and administrative experience

- BMW, Danone, Grey WorldWide, Jäger & Schmitter DIALOG, Heinrich-Schütz-Residence Dresden

Contact: anita.rick-blunck@martlutherinvest.com; Tel. +49 176 / 722 44 716

Reinhard Blunck

Managing Director Martluther Investment GmbH | Economist Uni Münster

- Internationally experienced General Manager in various industries and functions, including as Chief Financial Officer (CFO)

- Unilever, Gervais Danone, Bayer,

Werner & Mertz, MaxData, pfm medical

Angelika Hünerbein

Compliance Officer | Lawyer - OLG Cologne / University of Cologne

- Focus on foundation and business law

- Long-term chair of the foundation

- European Association, liaison and committee work - including for METRO subgroup and European. Public Policy Advisor Group in Brussels

current press releases

- Stocks, gold, funds – tips from a business psychologist

The expert – our managing director Anita Rick-Blunck – spoke about the opportunities and risks of investments. Due to current events, precious metals were also a focus.

Political decisions and various crises shape the markets – but those who invest wisely can seize opportunities and mitigate risks. A good portfolio needs balance – not (just) luck, was the key message of her presentation.